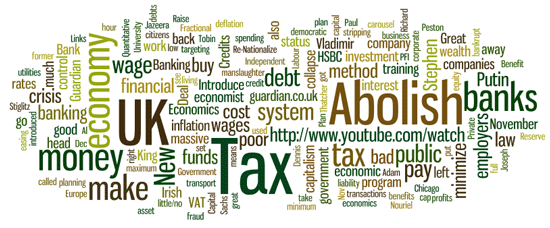

Solutions are;-

1/ The Chicago Plan of 1909, a version of the New Deal rejected by Franklin D Roosevelt as too radical.

This was essentially a program of public works; make work schemes with decent wages and severe restrictions/regulation on the activities on banks. The banking act introduced by FDR was less restrictive.

2/ Default on bad debts, make the speculators on debt pay.

3/ The Vladimir Putin method of dealing with Oligarchs and re-nationalizing while minimizing cost to the government.

3/ The Vladimir Putin method of dealing with Oligarchs and re-nationalizing while minimizing cost to the government.

Essentially collapse the share price of a company with a massive tax demand (or other methods) allows them to go bankrupt then buy them up for a fraction of the cost.

This approach could have been used by Gordon Brown in re-nationalizing the banks at a much reduced cost. Also as the banks had been allowed to go bankrupt, the debts would not be passed on to the government.

Avoiding the £1.3 Tn of the banks liabilities would have been a good idea

The Gov could supply credit directly cutting out the parasitical middle man in the form of the banks to stop the collapse in credit collapsing the economy.

4/ A citizens wage, also called a integrated Tax and Benefit system

5/ Abolish Tax Credits, as they are a subsidy for bad employers to make a profit paying poverty wages at the Taxpayers’ expense.

6/ Raise Tax thresholds.

7/ Raise benefits, as this will encourage employers to pay a living wage.

8/ A living minimum wage set above all the means tests, if you are working full time and have to claim means tested benefits to bring up a family, you do not have a job, and you are on a Stalinist work program. This would also minimize the cost to the Taxpayer of subsidizing bad employers to pay low wages.

9/ Introduce a proper progressive tax system.

10/ A maximum wage.

11/ A Tobin Tax., a tax on financial transactions

12/ Abolish non-domicile status.

12/ Abolish non-domicile status.

13/ Abolish New Deal which finances private companies to make massive profits while offering little/no training. Spend the money on REAL training.

14/ A Land Tax.

15/ A very high Tax on 2nd homes.

16/ Harmonize Corporation, Capital Gains and Income Tax, to minimize Tax avoidance. Private equity often pays capital gains tax of 5%, on the little Tax liability they admit to.

17/ Change the Tax laws so Private equity cannot set the massive debt it used to buy a company against its Tax liability, allowing them to pay little/no Tax.

18/ VAT to be paid at country of origin, to minimize VAT carousel fraud.

19/ A Glass Segal act, the separation of investment and deposit banking to minimize insider trading

20/ Off shore companies to have no legal status in UK law. This would mean these off-shore companies could not enforce payment in the UK courts, meaning that any company making money in the UK would have to be registered in the UK and pay UK tax.

21/ Abolish PFI with the Vladimir Putin method outlined above.

22/ Go back to the 1854 law on usury that put a cap on interest rates of 10%. This was an excellent suggestion by the campaigning group LONDON CITIZENS, in their anti usury campaign. This would mitigate the asset stripping of the poor by the capital rich.

23/ Abolish Academy Schools.

24/ Re-Nationalize public transport, see Vladimir Putin method again.

25/ Re-Nationalize the public utilities, see the Putin method again.

26/ Re-introduce real education, (if it really existed), abolish these pointless target driven policies.

27/ Introduce full Student Grants.

27/ Introduce full Student Grants.

28/ Take vocational training away from employers (as you only learn how to bodge to make them higher profits), and make it free at the point of use.

29/ Abolish Trident. And the rest of the UK nuclear weapons program

30/ Abolish Nuclear power.

31/ End military Imperialism for natural resources, as it is costly and politically de-stabilizing

32/ Repeal all the anti democratic legislation introduced by Conservatives and New Labour, too numerous to list.

33/ A proper law on corporate manslaughter involving jail.

34/ Abolish Job agencies, and impose a minimum length of contract.

35/ Protection against unfair dismissal from day 1.

36/ Abolish zero hour’s contracts.

37/ Abolish fake self employed status, very prevalent in the building industry.

38/ Introduce a maximum 32 hour week.

39/ Abolish inflation targeting (setting the interest rates to control inflation). Which leads to short term financial planning and a narrow view of economic planning? It after all did not take account of imported deflation from China, or control the housing bubble.

40/ Abolish Quantitive Easing (printing money to buy back government bonds) as this gives money to Hedge funds and investment funds (who hold Government Bonds) to speculate on food, fuel, other commodities and against the currencies/bonds of the countries that bailed them out

41/ Take away the ability of banks to create money, (Fractional Reserve Banking) and put this under democratic control so the Government not banks create money.

41/ Take away the ability of banks to create money, (Fractional Reserve Banking) and put this under democratic control so the Government not banks create money.

Most of the above boils down to the redistribution of wealth to stimulate the economy, if only a few have wealth nobody can buy stuff and the economy collapses.

The Plutocrats will concentrate wealth until the poor cannot even afford to eat, if they could get away with burning the poor to heat their swimming pools they would, they have to be stopped.

However given the present Cameron plans for the UK economy, the prognosis is not good.

There being little state assets left to sell, even the oils practically gone. Little spare industrial capacity to take advantage of the collapse in the value of sterling in the form of exports, (due to previous rounds of asset stripping), impoverished Social Capital, (Schools, University, and Other infrastructure such as transport), UK PLC is worthless.

As Author Daley said (in character) when asked about Mrs. Thatcher, He said,

“Thatcher, brilliant woman, got the utilities that the public already owned and sold it to them again”.

The current Con-Dem economic experiment will make dust what is left of the UK economy.

Essential Articles Links

On Adam Smith

http://www.independent.co.uk/news/business/comment/stephen-king/stephen-king-ten-things-people-thought-they-knew-about-economics-6265433.html#

Links on deflation

http://www.ft.com/cms/s/0/6e23cdc8-a517-11dd-b4f5-000077b07658.html

‘In today’s debt crisis, Germany is the US of 1931’

http://www.guardian.co.uk/global/2011/nov/24/debt-crisis-germany-1931

A Tobin Tax., a tax on financial transactions

http://en.wikipedia.org/wiki/Tobin_tax

Campaign for law on corporate manslaughter

VAT carousel fraud.

http://news.bbc.co.uk/1/hi/business/5369776.stm

On Neo liberalism/monetarism

Stephen King: The magicians of monetarism have very few tricks left up their sleeves (managing director of economics HSBC) Independent Monday, 29 August 2011

http://www.naomiklein.org/shock-doctrine/the-book.

Adam Curtis the Trap

http://www.archive.org/details/adamcurtistrap1

Joseph Stiglitz former head economist of the World Bank

http://www.guardian.co.uk/business/2010/feb/12/joseph-stiglitz-economics-creditcrunch.

Data on effects of inequality

http://www.equalitytrust.org.uk/why/evidence

On the banking bailouts

Not so much bail-out as rip-off’Nouriel Roubini Guardian 29 Sept 2008 http://www.guardian.co.uk/commentisfree/2008/sep/29/wallstreet.useconomy

The Great Bank Robbery Nassim Taleb

http://www.project-syndicate.org/commentary/taleb1/English

Is Richard Branson all he’s cracked up to be? Guardian 21 November 2011

http://www.guardian.co.uk/commentisfree/2011/nov/21/richard-branson-northern-rock

It’s in all our interests to understand how to stop another Great Depression guardian 10 October 2011 http://www.guardian.co.uk/commentisfree/2011/oct/10/stop-another-great-depression-debt

Can Europe pull back from the brink? Newsnight’s Paul Mason, Gillian Tett of the FT’s guardian.co.uk,

11 Nov 2011 http://www.guardian.co.uk/commentisfree/2011/nov/11/the-conversation-eurozone-crisis

Lloyds Banking Group admits £4.3 Bn of loses on Irish loans guardian 17th Dec 2010

http://www.guardian.co.uk/business/2010/dec/17/lloyds-banking-group-ireland-loan-losses

Peston on UK banking exposure to Irish property debt

http://www.bbc.co.uk/blogs/thereporters/robertpeston/2010/11/ireland_how_much_punishment_fo.html

Tax Credits

http://www.nao.org.uk/publications/0809/managing_variations_in_workloa.aspx

Tax Credits a modern ‘Speenhamland system’ http://en.wikipedia.org/wiki/Speenhamland_system

A citizens wage, also called a integrated Tax and Benefit system

On Keynesianism

Senator Dennis Kucinich and Robert Peston R4, Today on 17 Dec 2009 at 8.10 Am outlining why Obama plan will not work and why Chicago plan would.

http://news.bbc.co.uk/today/hi/today/newsid_7786000/7786997.stm

http://www.youtube.com/watch?v=VarQLVl9BtI

http://ideas.repec.org/p/lev/wrkpap/76.html

http://en.wikipedia.org/wiki/Burnham_Plan

On Speculation

Vulture funds circule EU bail out

http://www.bbc.co.uk/iplayer/episode/b016817r/File_on_4_Cash_from_the_Crisis/

Time to swoop on the vulture funds Tim Jones guardian.co.uk, Thursday 17 November 2011

http://www.guardian.co.uk/commentisfree/2011/nov/17/vulture-funds-law

Or speculation explained through Goats

Matt Taibbi April 5, 2010 Rolling Stone, ‘The Great American Bubble Machine’. “The first thing you need to know about Goldman Sachs is that it’s everywhere. The world’s most powerful investment bank is a great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money.” http://bigpicture.posterous.com/goldman-sachs-the-great-american-bubble-machi

Are you shocked by this stock market trader’s comments?

http://www.guardian.co.uk/business/poll/2011/sep/27/shocked-stock-market-trader-alessio-rastani

What price the new democracy? Goldman Sachs conquers Europe Stephen Foley Independent 18 Nov 2011 http://www.independent.co.uk/news/business/analysis-and-features/what-price-the-new-democracy-goldman-sachs-conquers-europe-6264091.html

Irish banks face mortgage strikes Henry McDonald in Dublin guardian.co.uk 18 November 2011

http://www.guardian.co.uk/business/2011/nov/18/ireland-banks-mortgages-repossession-new-beginnings

A cap on interest rates http://www.guardian.co.uk/politics/2009/aug/09/london-citizens-loan-sharks-rbs

http://www.guardian.co.uk/business/2009/jul/19/banking-royal-bank-scotlandgroup

Future payments across all PFI projects up until 2031-32 amount to 91 billion in today’s money

http://www.nao.org.uk/publications/0708/making_changes_in_operational.aspx

http://www.bbc.co.uk/iplayer/episode/b00l5gm4/File_on_4_23_06_2009/

New Labour ‘New Deal’/Workfare/Work Program

http://intensiveactivity.wordpress.com/2009/06/07/the-failed-new-deal-scheme-in-figures/

Joseph Stiglitz puts the figure for the Iraq War, the Afghan war and all the indirect costs at ₤20Bn for the UK taxpayer up to the year 2010

On inflation targeting Stephen King Managing Director of Economics HSBC

Quantitative easing

http://www.bbc.co.uk/iplayer/episode/b00x9z74/Face_the_Facts_Feeding_Frenzy/

http://www.guardian.co.uk/business/2011/apr/25/barclays-faces-commodity-protests

‘Quantitative easing ‘is good for the rich, bad for the poor’ Heather Stewart, 14 Aug 2011

http://www.guardian.co.uk/business/2011/aug/14/quantitative-easing-riots

Fractional Reserve Banking

Senator Dennis Kucinich again http://www.youtube.com/watch?v=kRVmpQcaM2w

On why sustainable economic growth can not be built on low wages

http://www.guardian.co.uk/commentisfree/2011/oct/04/global-recession-wealth-inequalities

http://www.guardian.co.uk/business/2005/apr/18/ukgeneralelection2005.economicpolicy

http://www.guardian.co.uk/business/2009/nov/14/bubble-fears-as-asset-prices-jump

Prognosis for world economy

Former member of the Bank of England Monetary Policy Committee, former head of European Economics at the London School of Economics and now head economist at Citygroup on the UK economy, William Buitler. http://blogs.ft.com/maverecon/2009/04/the-green-shoots-are-weeds-growing-through-the-rubble-in-the-ruins-of-the-global-economy/

Meltdown Al Jazeera a four part documentary on the financial crisis

http://www.aljazeera.com/programmes/meltdown/

Marxist explanation:

David Harvey on the crisis in capitalism

http://www.youtube.com/watch?v=qOP2V_np2c0

Professor Richard D Wolff

Larry Elliot Guardian 2/3/4 June 2008 ‘The Gods that Failed’

http://www.guardian.co.uk/business/2008/jun/02/globaleconomy.globalrecession

http://www.guardian.co.uk/business/2008/jun/03/economics.policy

http://www.guardian.co.uk/business/2008/jun/04/economicgrowth.banking

Nouriel Roubini of New York University stern business school on Al Jazeera ‘Is capitalism doomed’ and on why Marx was right “Karl Marx got it right, at some point capitalism can destroy itself,

http://english.aljazeera.net/indepth/opinion/2011/08/2011816104945411574.html

On the benefit of inflexible markets (FT)

http://www.ft.com/cms/s/0/f9e3fee4-0117-11de-8f6e-000077b07658.html?nclick_check=1

Economy on the Edge http://www.bbc.co.uk/worldservice/documentaries/2009/06/090608_economy_edge.shtml

Paul Krugman condemns coalition’s spending review austerity as a ‘fad’ Nobel-winning economist fears UK public will be ‘fashion victims’ of spending cuts that ‘boldly go in exactly the wrong direction’

http://www.guardian.co.uk/politics/2010/oct/22/paul-krugman-condemns-spending-review

http://www.nytimes.com/2010/10/22/opinion/22krugman.html?_r=2&ref=opinion

DEBTOCRACY http://www.youtube.com/watch?v=qKpxPo-lInk

A National Teach In On Austerity, Debt and Corporate Greed from NYC Frances Fox Piven and Cornel West

http://www.fightbackteachin.org/index.html

Stephen King (MD of economics HSBC) on the length of housing downturns

Jim Rodgers (one of Soros business acolytes) on sustainability of Sterling

The dual currency will allow a natural and essential adjustment of prices between Greece and other countries of the Eurozone without compelling the government to undertake the politically disastrous task of cutting salaries or jobs.